BONDS & LEVIES:

The Seeds of School Funding

How do schools receive the money they need to provide an education for all students? The answer is complex.

The root of the answer lies in state law. Washington is required to fully fund “basic education” based on a funding distribution formula referred to as the “prototypical model.” This model represents the Legislature’s assumptions about the costs associated with providing a “basic education” to student seedlings. Sadly, the money provided by the state for schools does not cover the actual cost of operating, constructing, and maintaining a school district. Local community funding measures, called levies and bonds, fill the gap between state funds and the real cost of providing the structures and services that help students grow and thrive.

Bonds are for building

Click to learn moreBonds are for building

A bond provides funding for capital projects such as purchasing property for schools, constructing new schools, or modernizing existing schools. Bonds are sold to investors who are repaid with interest over time from property tax collections, generally between 10-25 years.

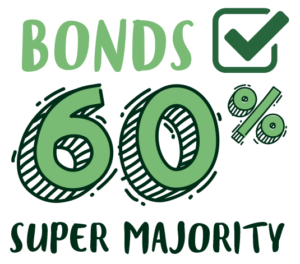

Bonds require a super majority to pass (60%)

Levies are for learning

Click to learn moreLevies are for learning

A levy is a short-term, local property tax passed by the voters of a school district that generates revenue for the district to fund programs and services that the state does not fund or fully fund as part of “basic education.”

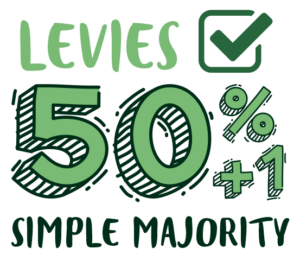

Levies require a simple majority to pass (50% + 1)

* The statement “levies are for learning” primarily refers to enrichment levies or EP&O levies.

Bonds are for building

Click to learn moreBonds are for building

A bond provides funding for capital projects such as purchasing property for schools, constructing new schools, or modernizing existing schools. Bonds are sold to investors who are repaid with interest over time from property tax collections, generally between 10-25 years.

Bonds require a super majority to pass (60%).

Levies are for learning

Click to learn moreLevies are for learning

A levy is a short-term, local property tax passed by the voters of a school district that generates revenue for the district to fund programs and services that the state does not fund or fully fund as part of “basic education.”

Levies require a simple majority to pass (50% + 1).

* The statement “levies are for learning” primarily refers to enrichment levies or EP&O levies.

Grow & thrive with local support

There are three main types of levies. Click on a sign to read more.

A replacement levy is the renewal of an existing enrichment levy that is about to expire. Much like a magazine subscription, levies must be renewed every few years. Typically, if a district is asking for a replacement levy to be approved by voters, it means that it is simply the continuation of an existing tax at the same rate.

Capital/Tech

Capital levies (which includes tech levies) fund things like modern technology, enhanced building security, and renovation projects. Capital levies can be approved for up to six years.

Enrichment

or EP&O

Enrichment levies, also known as Educational Programs and Operations (EP&O) or Maintenance and Operations (M&O levies), fund important school services and positions like teachers, support staff, supplies and materials, or services that the state only partially funds or doesn’t fund at all. State money for schools provided via the prototypical funding model does not fully cover the actual costs of operating a school district, so enrichment or EP&O levies bridge the funding gap. Enrichment levies can be approved for up to four years.

Transportation

Transportation levies fund things like new buses or major repairs to older buses to prolong their useful life. Transportation levies can be approved for up to two years.

Enrichment or EP&O levies

Enrichment levies, also known as Educational Programs and Operations (EP&O) or Maintenance and Operations (M&O levies), fund important school services and positions like teachers, support staff, supplies and materials, or services that the state only partially funds or doesn’t fund at all. State money for schools provided via the prototypical funding model does not fully cover the actual costs of operating a school district, so enrichment or EP&O levies bridge the funding gap. Enrichment levies can be approved for up to four years.

Capital/Tech levies

Capital levies (which includes tech levies) fund things like modern technology, enhanced building security, and renovation projects. Capital levies can be approved for up to six years.

Transportation levies

Transportation levies fund things like new buses or major repairs to older buses to prolong their useful life. Transportation levies can be approved for up to two years.

Garden-variety questions

Click on a question below to learn more:

This campaign was developed by ESD 112 Communications in partnership with the School Communications Collaborative.