School Levy Taxes

Understanding Your Taxes Under the State’s New Education Funding Plan

In 2017, Washington State’s education-related tax plan underwent an overhaul, and, as a result, your next state school property tax bill will look different.

Why?

In an effort to address the state’s constitutional duty to fund basic education, the State Legislature changed the way Washington funds K-12 education. The changes affect:

- Property taxes imposed by the state

- Certain voter-approved property taxes imposed by school districts

- State funding for most school districts

You can read the fine print in Engrossed House Bill 2242 at the Washington State Legislature website.

For More Information

If you have questions about your tax statements or property tax assessment, please visit the Clark County Treasurer’s website

This page is provided as a courtesy to our Clark County School Districts and the citizens of Clark County. Please contact your local school district for more information about your local school district’s property tax:

Please visit the Washington Department of Revenue website to find out more about the state property tax to support public schools.

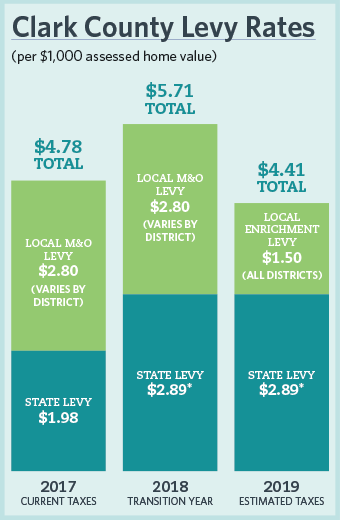

2018: The Transition Year

In 2018, the state will implement a “levy swap” that will cause a temporary one-year tax rate increase. The bump will occur in 2018, because it is a transition year. Existing voter-approved Maintenance and Operations (M&O) levies will remain in effect in local school districts, while the state phases in increased state levy collections.

In 2019, tax rates will likely be lower than in 2017, because school district M&O levies—now known as “enrichment levies”—will be limited to $1.50 per $1,000 of assessed value.

The 91-cent state levy increase in 2018 does not result in a direct 91-cent increase for Clark County school districts because the money is redistributed through the state. In fact, when the local levies are capped starting in 2019, many districts will have smaller operating budgets.

2019 School Funding Challenges

The school funding landscape in Washington state has changed dramatically resulting in significant financial challenges for many school districts.

NOTE: The new state public schools tax levy rate for 2018 through 2021 is $2.70 per $1,000 of assessed fair market value. However, the rate that will appear on Clark County’s 2018 tax bill will likely be $2.89 per $1,000 of assessed value, based on Clark County property valuations. (Rates will vary by county, because Washington State applies a ratio percentage to each county’s certified fair market values.)

OSPI does an excellent job explaining the school levy tax:

Total Levy Taxes–Here’s What We Know Now:

The state school property tax will increase by an estimated $0.81 per $1,000 assessed value (AV) in 2018. Locally-funded funded levies will be capped at $1.50 per $1,000 AV in 2019.

OSPI recently put forward two bills– SB 6362 and HB 2721 –to address the new levy cap. State Superintendent Chris Reykdahl also just released the previous video to explain the “levy cliff” issue that has arisen because of the levy cap.

To calculate total school levy taxes owed annually, the tax assessor uses the following formula: Assessed Home Value ÷ 1,000 x Total Levy Rate

Download a printable Clark County School Levy Tax Guide with an example chart illustrating what levy taxes could look like for a Clark County homeowner, accounting for a rise in property values of 3% per year.

The following ESD 112 region districts (including outside of Clark County) have funding measures in the February 13, 2018 election:

These changes come at a time when many districts’ levies are expiring, so communicating the funding changes to their voters has been a significant challenge, whether they are running replacement levies or new capital bonds.

- Battle Ground: $225 million Bond

- Castle Rock: 2-year Enrichment Levy

- Centerville: 2-year Educational Programs & Operations Levy and 2-year Tech Levy

- Evergreen: $695 million Bond

- Glenwood: 2-year Educational Programs & Operations Levy

- Kalama: 2-year Educational Programs & Operations Levy and $63 million Bond

- Kelso: 2-year Educational Programs & Operations Levy and $99 million Bond

- La Center: $48 million Bond

- Longview: 2-year Enrichment Levy and 4-year CPF/Tech Levy

- Roosevelt: 3-year Educational Programs & Operations Levy

- Wishram: 2-year Enrichment Levy

“It is critical that we continue to educate our communities on the vital role local levies play in providing comprehensive services for our students.”